Backdoor Roth Limit 2024 Income. Taxpayers making more than the $161,000 limit in 2024. Only clients who earn less than $240,000 (joint returns) or $161,000 (single filers) in 2024 can contribute directly to a roth ira.

If you’re ineligible for roth. A backdoor roth ira may be particularly appealing to those who earn too much to contribute directly to a roth ira.

Backdoor Roth Limit 2024 Income Images References :

Source: debbiqtabbatha.pages.dev

Source: debbiqtabbatha.pages.dev

Ira Limits 2024 For Backdoor Roth Coral Lianna, The ability to fund a roth starts to.

Source: lynbraphaela.pages.dev

Source: lynbraphaela.pages.dev

Backdoor Roth Contribution Limits 2024 Lois Sianna, For 2024, the income limit for roth iras is $161,000 for single filers and $240,000 for married individuals filing jointly.

Source: emileeqetheline.pages.dev

Source: emileeqetheline.pages.dev

Roth Ira Limits 2024 Limits Chart Aubrey Goldina, Options if you exceed the roth ira income limit.

Source: bilicynthie.pages.dev

Source: bilicynthie.pages.dev

Backdoor Roth Ira Limit 2024 Rahel Carmelle, The maximum ira contribution limit for 2024 is $7,000 for most account holders and $8,000 for those aged.

Source: lisbethwelysee.pages.dev

Source: lisbethwelysee.pages.dev

Backdoor Roth Limits 2024 Terry, In 2024, the contribution limit is $23,000 if you’re under 50 and $30,500 if you’re over 50.

Source: marceliawgertie.pages.dev

Source: marceliawgertie.pages.dev

Backdoor Roth Ira Contribution Limits 2024 Kanya Zitella, The contribution limit on individual retirement accounts will increase by $500 in 2024, from $6,500 to $7,000.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

How To Do A Backdoor Roth IRA (And Pitfalls To Avoid), For example, if you’re 30, you could put $2,000 in a traditional ira and $5,000 in a roth ira.

.png) Source: www.helloplaybook.com

Source: www.helloplaybook.com

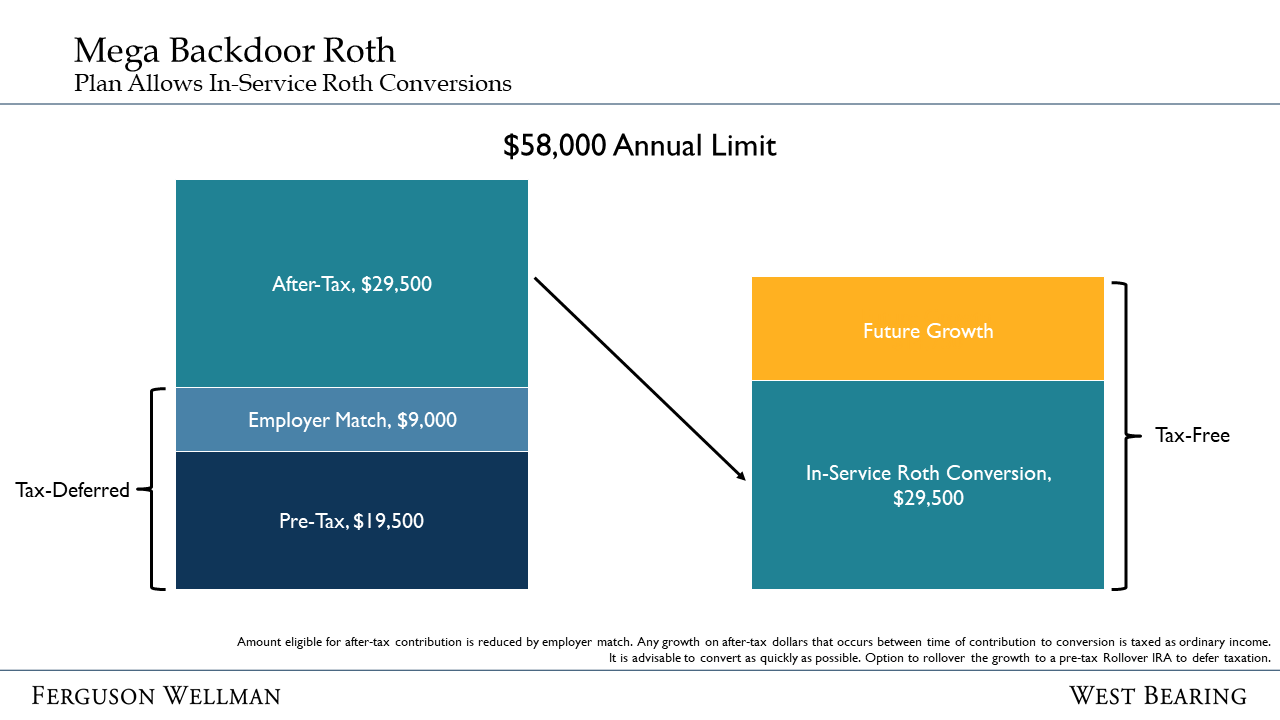

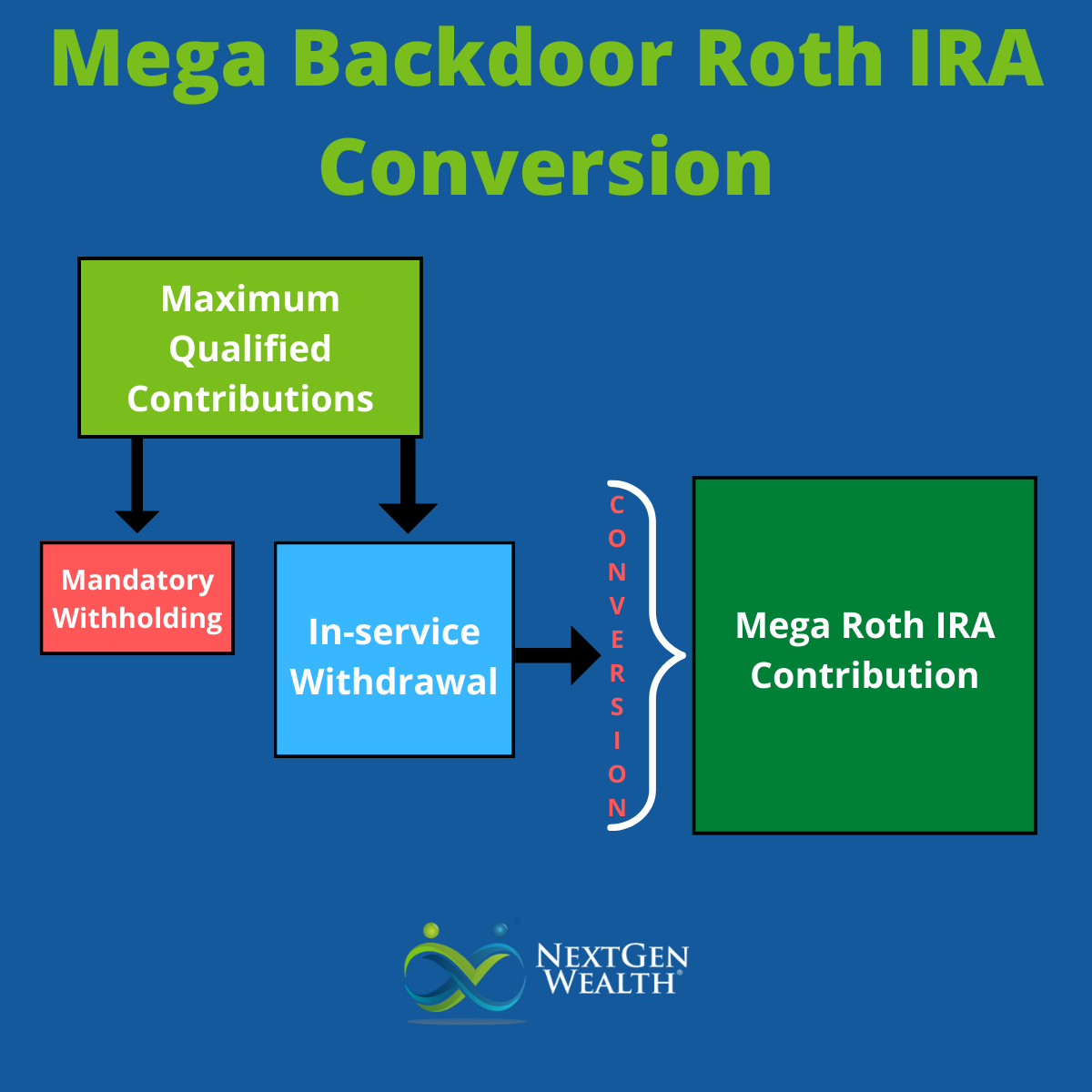

Mega Backdoor Roth Limit For 2024 + How It Works Playbook, But some advisors suggest another way.

Source: kassiqjoscelin.pages.dev

Source: kassiqjoscelin.pages.dev

Mega Backdoor Roth 2024 Limit Jeana Lorelei, A mega backdoor roth refers to a strategy that can potentially allow some people who would be ineligible to contribute to a roth account, based on their income or.

Source: www.helloplaybook.com

Source: www.helloplaybook.com

Mega Backdoor Roth Limit For 2024 + How It Works Playbook, Taxpayers making more than the $161,000 limit in 2024.