Business Mileage Reimbursement 2024. The current irs mileage rates (2024) april 7, 2024. Find out when you can deduct vehicle mileage.

Employers have the option of using the standard mileage rate to reimburse employees for mileage who travel using their own personal vehicles at the direction of. Claiming your business mileage for employees looking to claim their business mileage, here’s a simplified process:

The Optional Standard Mileage Rate For Business Use Of A Vehicle Increased Slightly From 2023.

You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable,.

The Automobile Allowance Rates For 2024 Are:

Certain trips listed inaccurate mileage or showed distances that would be too long to complete in a.

Employers Have The Option Of Using The Standard Mileage Rate To Reimburse Employees For Mileage Who Travel Using Their Own Personal Vehicles At The Direction Of.

Images References :

Source: timeero.com

Source: timeero.com

IRS Mileage Rate for 2023 What Can Businesses Expect For The, Employers have the option of using the standard mileage rate to reimburse employees for mileage who travel using their own personal vehicles at the direction of. Certain trips listed inaccurate mileage or showed distances that would be too long to complete in a.

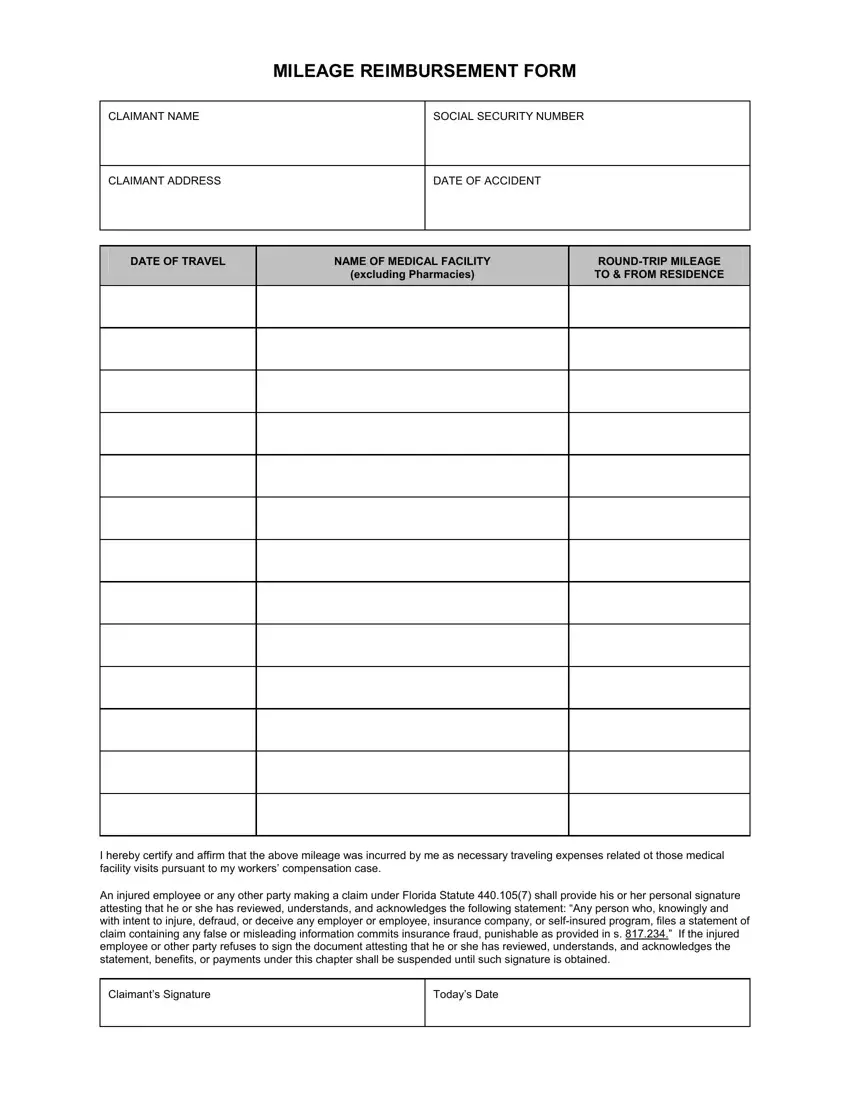

Source: formspal.com

Source: formspal.com

Mileage Reimbursement Form ≡ Fill Out Printable PDF Forms Online, The automobile allowance rates for 2024 are: 5p per passenger per business mile for carrying fellow employees in a car or van on journeys which are also work journeys for them.

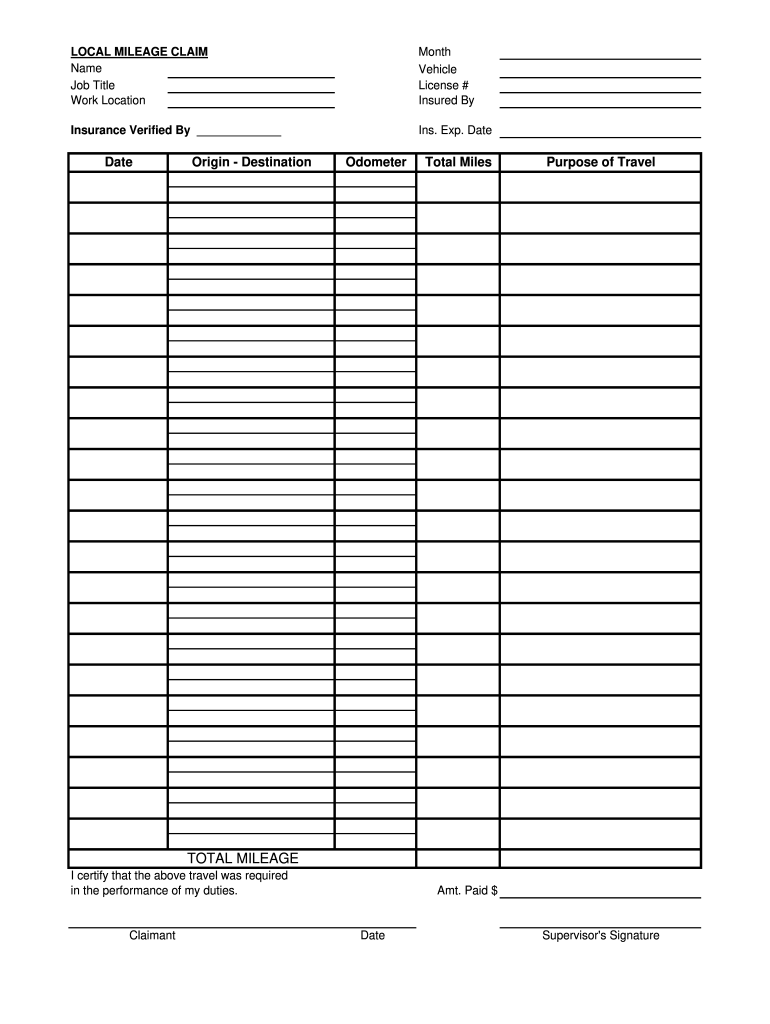

Source: printableformsfree.com

Source: printableformsfree.com

E Mail Pdf Fillable Form Printable Forms Free Online, The irs sets a standard mileage rate each year to simplify mileage reimbursement. Moving ( military only ):

Source: www.atlanticcityaquarium.com

Source: www.atlanticcityaquarium.com

Gas Mileage Expense Report Template, To work out how much you can claim, multiply the total business kilometres you travelled by the rate. This is not just a corporate courtesy, but a requirement in many jurisdictions, aimed at covering the wear and tear on personal vehicles used for business activities.

Source: www.dexform.com

Source: www.dexform.com

Mileage reimbursement form in Word and Pdf formats, Understanding the irs mileage reimbursement rules is crucial for employers, especially in states like california, massachusetts, and illinois, where reimbursement is. If the mileage rate you pay is no higher than the advisory fuel rates for the engine size and fuel type of the company car, there will be no taxable profit and no class.

Source: mileagereimbursement.blogspot.com

Source: mileagereimbursement.blogspot.com

Mileage Reimbursement 2021 Texas Mileage Reimbursement 2021, The irs’s latest guidance provides information on the 2024 standard mileage rates, crucial for calculating deductible automobile. The automobile allowance rates for 2024 are:

Source: printableformsfree.com

Source: printableformsfree.com

2023 Mileage Reimbursement Form Printable Forms Free Online, Things to remember apportion for private and business use Find out when you can deduct vehicle mileage.

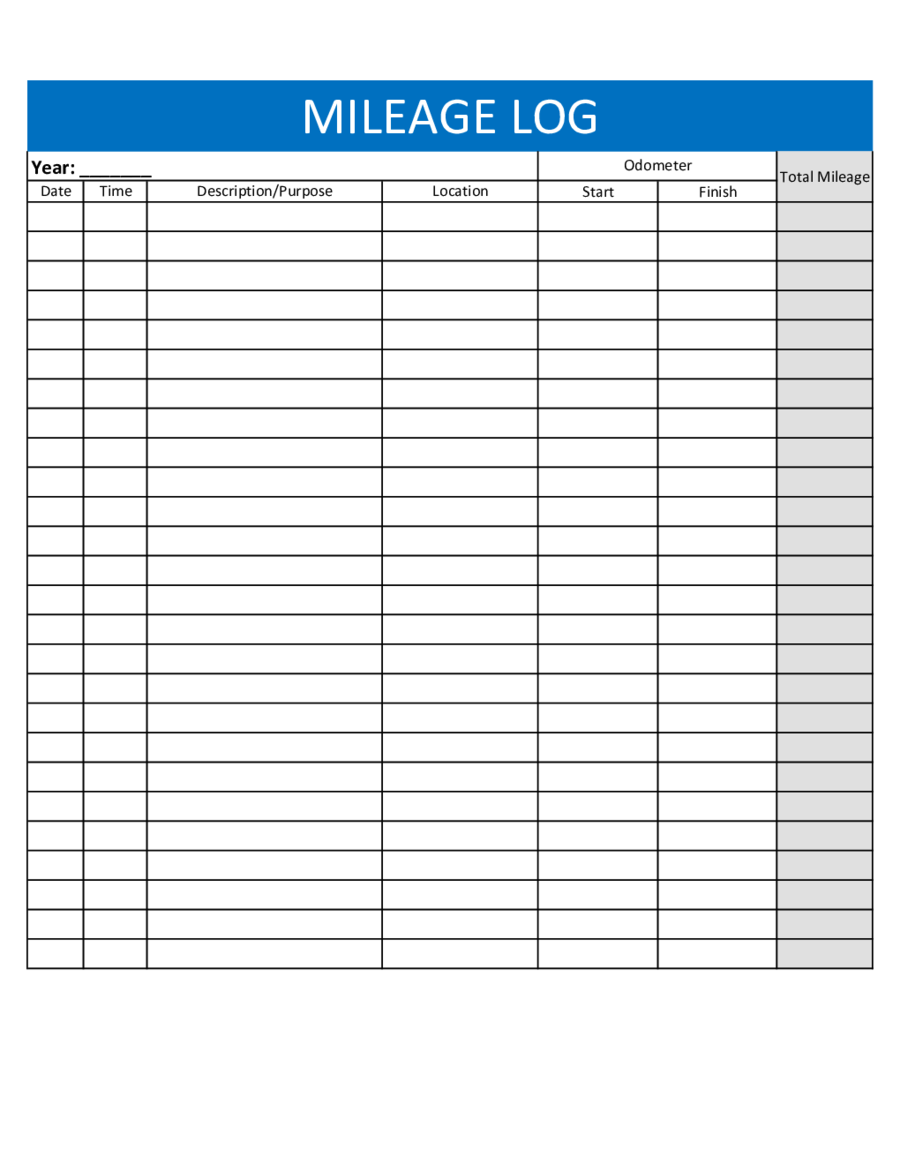

Source: templates.rjuuc.edu.np

Source: templates.rjuuc.edu.np

Mileage Chart Template, See how much you get back with our mileage reimbursement calculator having employees use their own vehicle for work can be expensive. If the mileage rate you pay is no higher than the advisory fuel rates for the engine size and fuel type of the company car, there will be no taxable profit and no class.

Source: www.pdffiller.com

Source: www.pdffiller.com

2022 Form VA Application High Mileage Discount Fill Online, Printable, The salesperson can use the standard mileage rate for the business mileage of the three cars and the two vans because they don’t use them at the same time. You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable,.

Source: reeqesmaria.pages.dev

Source: reeqesmaria.pages.dev

Mileage Rate 2024 Iowa Robby Christie, 64¢ per kilometre driven after that in the northwest territories, yukon, and. The irs’s latest guidance provides information on the 2024 standard mileage rates, crucial for calculating deductible automobile.

5P Per Passenger Per Business Mile For Carrying Fellow Employees In A Car Or Van On Journeys Which Are Also Work Journeys For Them.

Mileage reimbursement is a way to compensate individuals for the expenses they incur when using their personal vehicles for business, medical, moving, or charitable.

17 Rows The Standard Mileage Rates For 2023 Are:

At the end of last year, the internal revenue service published the new mileage rates for 2024.