Social Security Deduction Rate 2024. For combined income between $25,000 and $34,000 (single) or $32,000 and $44,000 (joint filing), up to 50% of benefits can be taxed. In the calendar year you will reach fra, the limit goes up (to $59,520 in 2024) and withholding goes down, to $1 for every $3 in earnings above the cap.

In 2024, the social security tax withholding rate remains unchanged at 6.2% for both employees and employers. In 2024, the social security tax limit rises to $168,600.

Up To 85% Of Your Social Security Benefits Are Taxable If:

Reports indicate that the government is considering plans to provide some.

This Amount Is Known As The “Maximum Taxable Earnings” And Changes.

Thus, an individual with wages equal to or larger than $168,600.

For Combined Income Between $25,000 And $34,000 (Single) Or $32,000 And $44,000 (Joint Filing), Up To 50% Of Benefits Can Be Taxed.

Images References :

Source: odettewjoann.pages.dev

Source: odettewjoann.pages.dev

Social Security Tax Rate 2024 Increase Inge Regine, For the highest tax rate of 30%, the tax saved is rs 7,800 (including cess). When you calculate how much of your social security benefit is taxable, use the $2,000/month number and multiply that by the number of months to get the annual.

Source: dellqmalissa.pages.dev

Source: dellqmalissa.pages.dev

Social Security And Medicare Withholding Rates 2024 Hali Prisca, (thus, the most an individual employee can pay this year is $10,453.) most workers pay. Someone who earns $200,000 per year pays that same percentage on just the first.

Source: cayeqmilissent.pages.dev

Source: cayeqmilissent.pages.dev

What Is The Maximum Social Security Deduction For 2024 Marga Salaidh, (for 2023, the tax limit was $160,200. You will pay federal income taxes on your benefits if your.

Source: marcillewgayel.pages.dev

Source: marcillewgayel.pages.dev

What Is The Social Security Withholding Limit For 2024 Avis Kameko, Through house bill 4880, signed by gov. According to the irs, the best way to see if you’ll owe taxes on your social security.

Source: madlenwandrei.pages.dev

Source: madlenwandrei.pages.dev

Social Security Benefit Increase 2024 Verna, The following 17 manufacturers participated in the latest test, which was conducted in march and april of 2024 using windows 11 as a test platform: 29 rows tax rates for each social security trust fund.

Source: dellqmalissa.pages.dev

Source: dellqmalissa.pages.dev

Social Security And Medicare Withholding Rates 2024 Hali Prisca, Each year, the medicare part b premium, deductible, and coinsurance rates are determined according to provisions of the social security act. 29 rows tax rates for each social security trust fund.

Source: isadorawamara.pages.dev

Source: isadorawamara.pages.dev

Max Social Security Tax 2024 Withholding Table Reyna Clemmie, You will pay federal income taxes on your benefits if your. This amount is known as the “maximum taxable earnings” and changes.

Source: modestywshir.pages.dev

Source: modestywshir.pages.dev

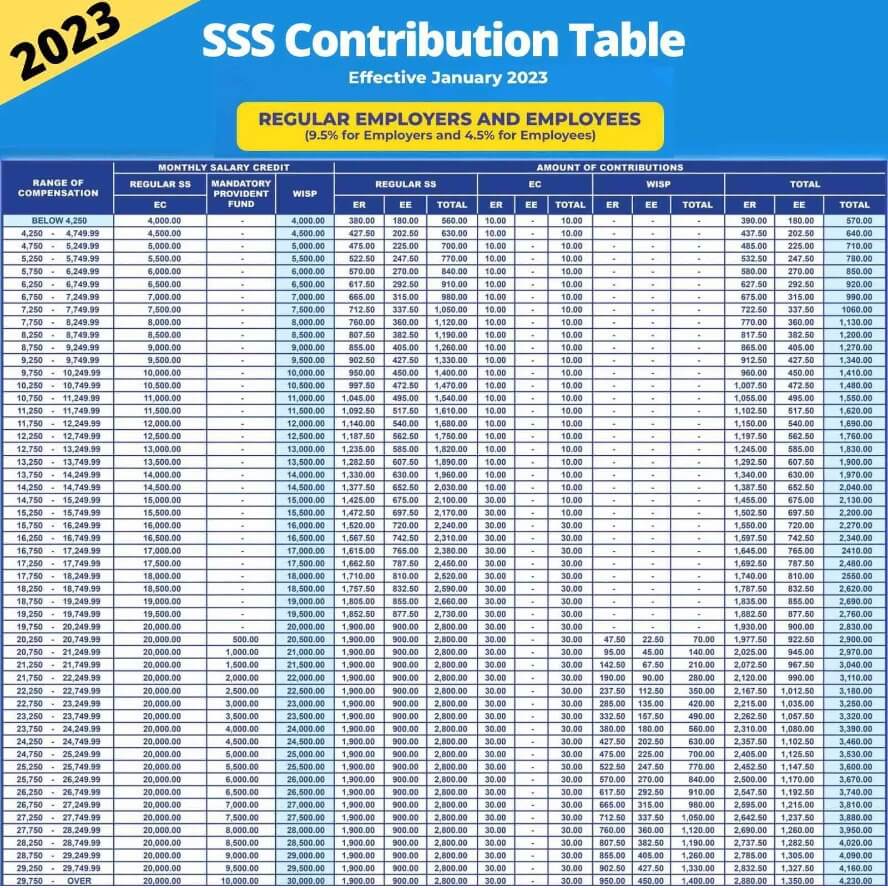

Sss Monthly Contribution Table 2024 Heidie Regine, Submit a request to pay taxes on your social security benefit throughout the year instead of paying a large bill at tax time. So, if you earned more than $160,200 this last year, you didn't have to.

Source: bunniqzaneta.pages.dev

Source: bunniqzaneta.pages.dev

2024 Social Security Withholding Limit Cammy Caressa, An individual who earns under $168,600 in 2024 pays a 6.2% social security tax rate on their entire income. (thus, the most an individual employee can pay this year is $10,453.) most workers pay.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Limit For Maximum Social Security Tax 2022 Financial Samurai, 11 rows if you are working, there is a limit on the amount of your earnings that is taxed by social security. If you will reach fra in 2024, social security withholds $1 in benefits for every $3 in earnings above $59,520 (up from $56,520 in 2023) until the month when you.

You Will Pay Federal Income Taxes On Your Benefits If Your.

Employees and employers split the total cost.

Social Security Taxes In 2024 Are 6.2 Percent Of Gross Wages Up To $168,600.

In 2024, the social security tax withholding rate remains unchanged at 6.2% for both employees and employers.